Insolvency Accounts Individual & Partnership Firm BCOM 1st Year Short Notes

2. Insolvency of a Partnership Firm : A partnership firm may be insolvent like an individual. A partnership firm is said to be insolvent when all its partners are adjudged insolvent. It may be said, in other words, a partnership firm will be insolvent if the payment of the liabilities of the firm can not be made by the realisable value of the firm’s and private assets of the partners. In such a case, the insolvency of firm as well as insolvency of partners are taken together. The official receiver appointed for the firm also becomes the official receiver for the individual partners.

In case of insolvency of partnership firms, separate statement of affairs and deficiency accounts are nrepared. When making payment to the creditors, assets of the firm are first utilised for the payment of the liabilities of the firm. Similarly private assets of a partner are first utilised for the payment of his private liabilities.

3. Unsecured Creditors: Such creditors of the insolvent debtor, who have got no security for their debts, are called unsecured creditors. For example trade creditors, bills payable, bank overdraft, wife loan, liability for bills discounted or endorsed by the insolvent debtor, unsecured loan and the amount due in respect of salaries, wages or rent Unsecured creditors are included in the List A of the statement of affairs. In other words, it may be said that the creditors who do not hold any assets of the insolvent debtor are known as unsecured creditors. Such creditors are paid in the last when payment is made by the official receiver.

Following are main examples of unsecured creditors :

1. Trade creditors,

2. Bills payable,

3. Unsecured loan,

4. Bank overdraft,

5. Wife loan,

6. Bills discounted and expected to be dishonoured,

7. Outstanding salary, wages and rent which is not preferential.

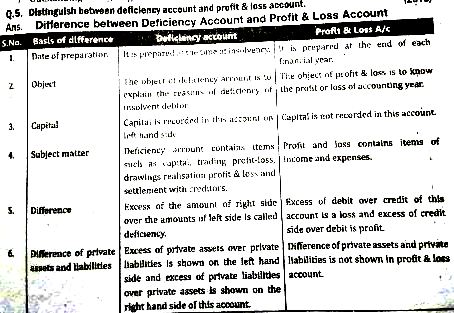

Q.5. Distinguish between deficiency account and profit & loss account.(2016)

Ans. Difference between Deficiency Account and Profit & Loss Account

Q.6. How will you treat the following transactions with reference to insolvency accounts?

1. Loan from wife or husband.

2. Purchase of ornaments out of drawings.(2014)

Ans. 1. Loan from Wife or Husband: Loan from wife is treated as unsecured creditors. If the loan out of her ‘Stridhan’ (i.e. out of her self earned money or money received by her from her father), this amount will be shown both on the ‘Gross liabilities’ column and ‘Expected to rank’ column. But if the has given loan to her husband out of money given to her by the husband, then she cannot rank as a creditor. The amount of wife loan, in such a case, will be shown in the ‘Gross liabilities’ column only in List ‘A’ but not in the ‘Expected to Rank’ column. The amount of wife loan exempted from payment will be shown on the left hand side of deficiency account as the capital of the proprietor.

2. Purchase of Ornaments out of Drawings: If the insolvent debtor purchases ornaments out of drawings, then these ornaments will be used for the payment of creditors. These ornaments will be shown in ‘List E’ as private assets and also in deficiency account on the left hand side by the name of excess of private assets over private liabilities. But the ornaments received by the wife from her father or brother cannot be used for this purpose.

Q.7. Distinguish between balance sheet and statement of affairs.

Ans. Difference between Statement of Affairs and Balance Sheet

The statement of affairs and balance sheet both statements show the assets and liabilities. In both the statements, assets are shown on the right hand side and liabilities on the left hand side. But there are certain important differences between these two statements. The principal differences are as follows:

1. Time: A balance sheet is usually prepared at the end of each accounting year whereas a statement of affairs is prepared only once when an adjudication order has been passed by a court against a debtor.

2. Nature: A balance sheet shows the financial position of business whereas the statement of affairs shows a picture of pitiable condition of insolvent debtor.

3. Object: Balance sheet is prepared to show the financial position of the business both to outsiders and insiders whereas the object of preparing the statement of affairs is to know the amount available for distribution amongst the unsecured creditor and the amount of deficiency. Balance sheet does not show such figures.

4. Format: There is no set format of the balance sheet of an individual or a partnership firm but a statement of affairs is prepared in a prescribed form as laid down under Insolvency Acts.

5. Arrangement of Assets and Liabilities: In a balance sheet, assets and liabilities are arranged in the order of liquidity or in the order of permanence but in the statement of affairs, they are grouped in a different manner. All creditors are divided into four groups-(a) unsecured, (b) fully secured, (c) partly secured and (d) preferential; all assets are divided into three groups, viz. (a) property, (b) book debts and (c) bills of exchange. Separate lists are used for each class of creditor and asset.

6. Fictitious Assets: A balance sheet shows all types of assets including fictitious and intangible assets on the assets side. But a statement of affairs shows only such assets that have value; fictitious and intangible assets having no value do not find a place in a statement of affairs.

7. Gross Value Column: The balance sheet does not have a separate column for the gross value of liabilities but a statement of affairs has such a column.

8. Values: A balance sheet shows all assets and liabilities at their book values but in a statement of affairs, assets are shown at their estimated realisable values and in respect of liabilities, their expected rank values are also shown together with their gross values.

9. Preferential Creditors: In a statement of affairs, preferential creditors are shown as a deduction from the total of the amounts realised from various assets but in a balance sheet, all types of creditors are shown on the liabilities side.

10. Deficiency Amount: Statement of affairs is followed by a deficiency account whereas balance sheet is preceded by an income statement.

11. Capital and Other Related Items: A balance sheet shows the proprietor’s capital, reserves, undistributed balance of profit & loss account and drawings; a statement of affairs excludes all these items.

12. Private Assets and Liabilities: Private assets and private liabilities are included in the statement of affairs of a sole trader but these are not shown in a balance sheet.

13. Prepared for Whom: The balance sheet is prepared for the satisfaction of the owner whereas statement of affairs is prepared for the satisfaction of the court.

14. Encumbered Assets: These are shown on the assets side of balance sheet whereas in statement of affairs, they are adjusted from the amount of concerned creditors on the liabilities side.

15. Total: The balance sheet always balances whereas in statement of affairs the total of liabilities side exceeds the total of assets side.

Q.8. What lists are shown on the liabllities side of the statement of affairs? Explain.(2015)

Ans. The liabilities of the insolvent are classified into four lists and shown on the liabilities sides of the statement of affairs. Explanation of these lists are as follows:

1. Unsecured Creditors as Per List A: Such creditors of the insolvent debtors are included in this list, who have got no security for their debts, e.g, trade creditors bank overdraft, bills payable, wife loan, liability on bills discounted and unsecured loans.

2. Fully Secured Creditors as Per List B: All those creditors who contain securities of the insolvent debtors are included in this list. The realisable value of such securities are either equal to or more than the amount of the claims of such creditors. Any surplus of the securities in the hand of fully secured creditors after meeting their claims is transferred to the assets side of the statement of affairs where it is shown after list G.

3. Partly Secured Creditors as Per List C: This list contains such creditors who have security of a value less than the amount of their claims. The unsatisfied amount of these creditors is written in the ‘Expected to rank’ Column.

4. Preferential Creditors as Per List D: This list contains such creditors who are although unsecured but have the priority of payment over other unsecured creditors.

B.Com Ist Year Foreign Trade And Economic Growth Question Answer Notes

[PDF] B.Com 1st Year All Subject Notes Study Material PDF Download In English

B.Com 2nd Year Books Notes & PDF Download For Free English To Hindi

B.Com 1st Year Notes Books & PDF Free Download Hindi To English

B.Com 1st 2nd 3rd Year Notes Books English To Hindi Download Free PDF

B.Com Ist Year Unemployment Short Study Notes Question Answer

Follow Me

Leave a Reply